Resource Hub

How to Budget for Childcare: A Financial Planning Guide for NZ Families

Published · Last updated · 8 min read

Contents

How do I budget for childcare in NZ?

Work out your *true* weekly cost (fees + optional charges + ‘you still pay when they’re sick’ days), then subtract every subsidy you can stack — [20 Hours ECE](/blog/20-hours-ece-nz-explained), [FamilyBoost](/blog/familyboost-childcare-tax-rebate-nz), and (if you qualify) the WINZ Childcare Subsidy. Next, run a return-to-work break-even check using your after-tax pay and any Working for Families changes. Finally, turn it into a monthly cashflow plan that can handle quarterly FamilyBoost refunds and school-holiday spikes.

Start with the right framing: childcare is a household investment

Childcare is expensive, and budgeting for it can feel personal. A useful mindset shift: treat it like an investment your household is making in time (to work, study, rest) and in your child’s learning — not a ‘nice to have’ you should feel guilty about.

It doesn’t make it cheap. It just makes the trade-offs (hours, location, care type) easier to talk about.

New to the costs side of things?

Run your numbers in 3 minutes

Step 1: Calculate your true childcare costs (not just the advertised rate)

Childcare budgeting falls over when you only budget for the headline hourly rate. The real number is your booked hours plus the extras that show up later: optional charges, minimum-day rules, and the weeks you pay even when your child is home sick.

Keep it simple: calculate core fees, add predictable add-ons, then add a small buffer.

What to include in ‘true cost’

- Booked hours × rate (and ask if under-2s are priced differently).

- Optional charges you’ve agreed to (food, nappies, excursions). MoE guidance: https://www.education.govt.nz/education-professionals/early-learning/funding-and-financials/ece-funding-handbook/chapter-4-20-hours-early-childhood-education/4-3-fees-donations-optional-charges-and-home-based-educator-top-up-payments

- Absences/holidays/closures (do you still pay for booked days?).

- One-offs (enrolment fee, bond, uniforms, bedding).

- Transport + a buffer (parking/petrol + 5–10%).

If you haven’t done it yet, pull out your enrolment agreement and highlight anything that mentions ‘minimum attendance’, ‘optional charges’, ‘notice period’, and ‘fees during absence’. Those clauses drive your budget more than the marketing brochure does.

A simple weekly template (copy/paste)

| Line item | How to calculate | Weekly amount |

|---|---|---|

| Core fees | Booked hours × hourly rate | $___ |

| Optional charges you agreed to | Daily/weekly charge × booked days | $___ |

| One-offs spread across the year | (annual total ÷ 52) | $___ |

| Transport | (petrol + parking) for drop-offs/pick-ups | $___ |

| Buffer | 5–10% of the above | $___ |

| **True weekly cost (before subsidies)** | Sum | **$___** |

Watch out for the quiet extras

Step 2: Map every subsidy you can use (and how they stack)

New Zealand’s childcare support is messy, but you can get real savings when you stack it properly. For most families, the big three are: 20 Hours ECE, FamilyBoost, and the WINZ Childcare Subsidy/OSCAR.

Some support reduces your bill straight away (for example, WINZ subsidies paid to the provider). FamilyBoost comes back later, so plan your cashflow.

20 Hours ECE (ages 3–5): free hours, with rules

If your child is 3, 4, or 5, they can use 20 Hours ECE for up to 20 hours a week and 6 hours a day. The Ministry of Education states you cannot be charged fees for any of the hours your child is signed up to receive as 20 Hours ECE. Source: 20 hours funding for early childhood education.

Centres can charge for hours outside those 20 hours. They can also request optional charges (for example, food or excursions), but they have to be handled properly and agreed to in writing. If you want the practical parent version (what’s ‘free’, what isn’t), read: 20 Hours ECE NZ explained.

FamilyBoost: quarterly cash back on ECE fees

FamilyBoost is Inland Revenue’s childcare payment for eligible households paying for licensed early childhood education. You claim it every 3 months (quarterly) through myIR using invoices from your provider.

For quarters ending after 1 July 2025, IRD says you can claim up to 40% of eligible ECE costs, up to $1,560 per quarter. Eligibility depends on your household income for the quarter (under $35,000 gets the full percentage; above that it abates, and it cuts off at $57,286). Source: How much FamilyBoost you are eligible for.

Budgeting tip: treat FamilyBoost like a quarterly ‘refund’, not weekly income. It’s easy to feel broke every week and then get a lump sum later. We cover a simple cashflow system in: FamilyBoost childcare tax rebate NZ.

WINZ Childcare Subsidy + OSCAR: income-tested help

Work and Income can help with childcare costs if you’re working, studying, training, or in some approved situations. The Childcare Subsidy is for under‑5s; OSCAR is for before/after school care and holiday programmes. Start points: https://www.workandincome.govt.nz/eligibility/children/childcare.html

Eligibility and rates depend on your income and child count. Work and Income’s tables note a maximum hourly subsidy (for example, $6.52/hour is referenced in their provider summary). Source: https://www.workandincome.govt.nz/providers/childcare-and-oscar/types-of-childcare-available.html

If you think you might qualify, don’t wait until your first invoice is overdue. Start the application early (Work and Income often recommends applying weeks before you need the subsidy to start).

Make yourself a one-page ‘subsidy map’

This is the page you want on the fridge. List what applies, how it’s paid, and when it hits your bank account.

| Support | Who it applies to | How it shows up in your budget |

|---|---|---|

| 20 Hours ECE | Most children aged 3–5 (if your service offers it) | Reduces fees for nominated hours immediately |

| WINZ Childcare Subsidy / OSCAR | Income-tested; depends on work/study and circumstances | Often paid to provider; reduces weekly bill |

| FamilyBoost | Eligible households with children 5 and under | Quarterly refund; build a sinking fund |

| Working for Families (WFF) | Eligible families with dependent children | Weekly/fortnightly payments or annual lump sum; may reduce as income rises |

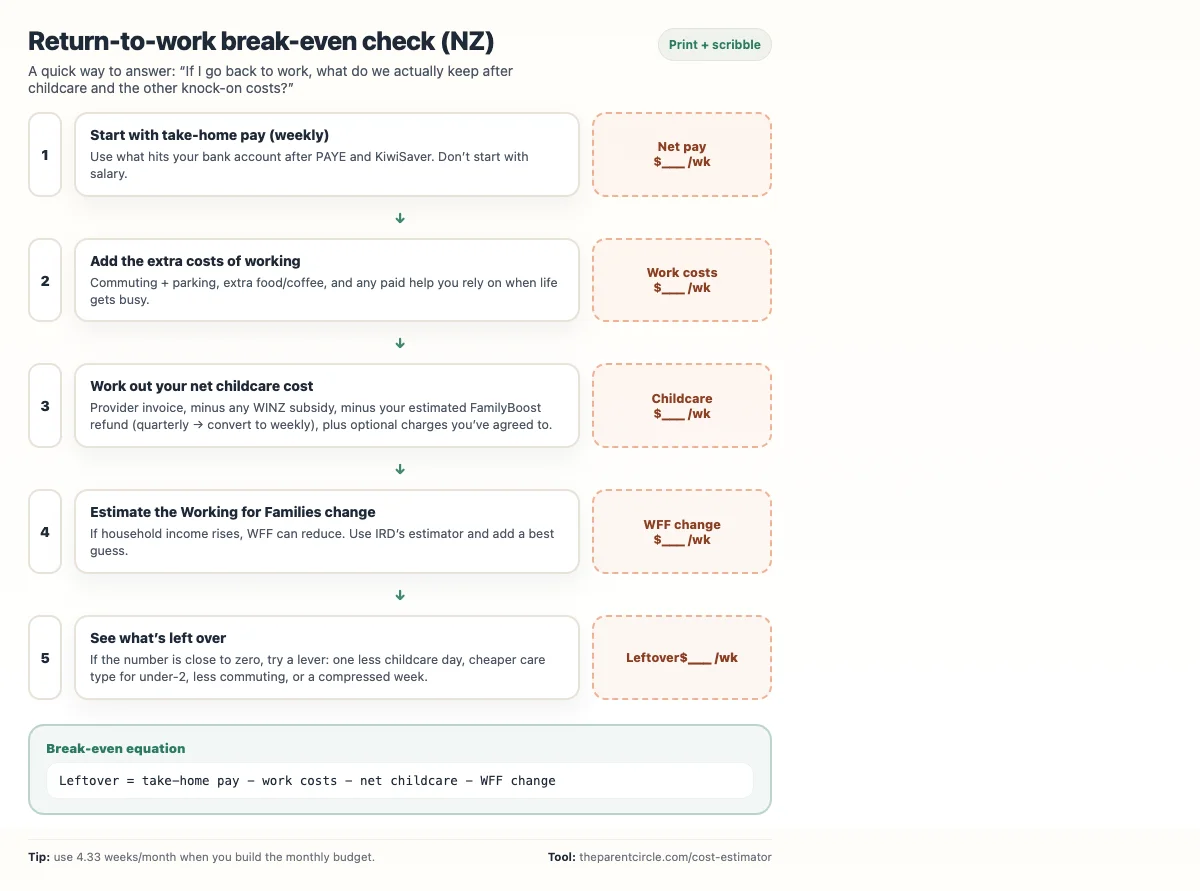

Step 3: Work out your return-to-work ‘break-even’ point

This is the part parents whisper about: ‘Is it even worth going back?’ The only honest answer is: it depends on your after-tax pay, the net childcare bill (after subsidies), and the extra costs of working. For many families, the first few months back are tighter than expected.

A break-even calculation doesn’t tell you whether you should work. It just stops you from being surprised. And it gives you something concrete to discuss with your partner and your employer.

A practical break-even formula

Break-even (weekly)

If the number is close to zero (or negative), you’re in the ‘we’re basically doing this for non-financial reasons’ zone — which is still a valid choice.

What parents forget to include

- Use take-home pay, not salary.

- Include WFF changes (run IRD’s estimator; WFF usually reduces as income rises).

- Commuting + parking.

- The ‘outsourcing’ drift (more takeaways, paid help when everyone’s exhausted).

Worked example: 3 days back at work

Example (rough numbers): one parent returns 3 days/week (24 hours) at $30/hour. That’s $720 gross, and say $520/week take-home after PAYE/KiwiSaver (your exact number will differ).

Childcare: 24 hours at $10.50/hour = $252/week. They claim FamilyBoost and estimate an average $101/week back (paid quarterly), so net childcare is about $151/week.

Other impacts: $75/week commuting/incidentals, and they estimate WFF drops by $30/week once income rises.

| Item | Weekly |

|---|---|

| After-tax pay gained | $520 |

| Less: net childcare (after FamilyBoost) | −$151 |

| Less: extra work costs | −$75 |

| Less: WFF change | −$30 |

| **Money left over** | **$264/week** |

If your leftover ends up close to zero, look for one lever that changes the result (one less day of care, cheaper under‑2 care, less commuting) rather than trying to ‘optimise’ everything.

A one-page flowchart: how to run your break-even check

Step 4: Build a monthly childcare budget (with a cashflow plan)

Childcare invoices are often weekly, but most households budget monthly. Translate weekly costs into monthly numbers, then plan for the lumpy bits: quarterly FamilyBoost refunds and school-holiday changes.

Use 4.33 as the ‘weeks per month’ multiplier (52 weeks ÷ 12 months). It’s more accurate than multiplying by 4 and then wondering why you’re always short.

Monthly childcare budget template

| Line item | Monthly estimate (formula) | $ |

|---|---|---|

| Provider fees you actually pay | (weekly fees to provider) × 4.33 | $___ |

| Optional charges you agreed to | (weekly optional charges) × 4.33 | $___ |

| Transport (childcare-related) | weekly transport × 4.33 | $___ |

| Buffer (sick days/late fees/term extras) | $20–$50/week × 4.33 | $___ |

| Less: WINZ subsidy paid to provider (if applicable) | weekly subsidy × 4.33 | −$___ |

| Less: FamilyBoost sinking fund (expected) | (expected quarterly refund ÷ 3) | −$___ |

| **Net monthly childcare budget** | Sum | **$___** |

The key move there is the FamilyBoost sinking fund. When the refund arrives, you don’t ‘spend it’ — you use it to refill the sinking fund or pay down the childcare line in your budget.

Worked example (one child, age 3, 4 days/week)

Example: a 3‑year‑old attends 4 days/week. The centre charges $88/day, and $6/day optional charges for food/resources. After applying 20 Hours ECE, the weekly invoice is $160 (fees) + $24 (optional) = $184/week.

The family expects FamilyBoost to return about $64/week-equivalent on the eligible fees portion (paid quarterly). They set that aside as a sinking fund, so the budgeted weekly cost becomes roughly $120 + $24 = $144/week.

| Item | Weekly | Monthly (×4.33) |

|---|---|---|

| Provider invoice (fees + optional) | $184 | $797 |

| Less: FamilyBoost sinking fund | −$64 | −$277 |

| Net budgeted cost | $120 | $520 |

Your goal is to avoid the ‘why are we short this month?’ surprise.

Childcare budgeting tips that actually move the needle

If you’re trying to make childcare affordable, it usually comes down to three levers: hours, care type, and subsidy capture. Everything else is marginal.

- Use 20 Hours ECE deliberately. You can split hours across services (still capped at 6 hours/day and 20 hours/week). Source: https://www.education.govt.nz/early-childhood/funding-and-data/20-hours-ece-for-ece-services

- Challenge minimum-day policies. If you only need 3–4 days, don’t let a ‘5 days only’ rule quietly set your budget.

- Reduce one childcare day via flexible work. A WFH day, earlier starts, or a 9‑day fortnight can remove a full day of paid care.

- Plan for cashflow. Treat FamilyBoost as a quarterly refund and use a sinking fund so weekly budgets don’t feel like panic.

- Ask about sibling discounts and fee reviews. Many centres will tell you if you ask directly.

- Compare total weekly cost, not daily rate. Optional charges and minimum hours can flip the ‘cheapest’ centre.

Tax implications: FamilyBoost, Working for Families, and donations

Childcare support exists, but it’s not automatic. If you’re budgeting seriously, treat tax and entitlements as part of the plan: keep invoices for FamilyBoost, and expect Working for Families to move when your household income moves.

FamilyBoost: plan for proof and timing

FamilyBoost is claim-based, so two actions matter: keep invoices and claim each quarter in myIR. IRD assesses eligibility using your household income for that quarter. Source: https://www.ird.govt.nz/familyboost/can-you-get-familyboost/how-much-familyboost-are-you-eligible-for

Working for Families: expect it to move when income moves

When one parent returns to work, you might gain wages and lose some Working for Families through abatement. IRD’s starting points: https://www.ird.govt.nz/working-for-families and the estimator: https://www.ird.govt.nz/working-for-families/estimate-your-entitlement

Plan for the moments when costs change

Childcare costs don’t stay flat. They jump and drop at predictable points — and if you plan for those points, budgeting gets much less stressful.

- Turning 2: fees may drop when your child moves out of the under‑2 room.

- Turning 3: 20 Hours ECE may kick in (if your service offers it).

- Starting school: daycare fees stop, but OSCAR + holiday care can appear.

- New sibling overlaps: plan a temporary ‘childcare spike’ budget.

When the numbers don’t work (right now)

Sometimes you do the maths and it’s genuinely brutal. No judgement. This is a common phase, especially with two children under 5.

If you’re in that spot, the goal shifts from ‘perfect’ to ‘workable’: reduce paid hours, use family help if you have it, or find a cheaper care mix until the next milestone (age 3 / school start) changes the equation.

Lower-cost alternatives to consider

- Split-shift parenting to reduce paid hours.

- Compressed weeks / WFH to remove a childcare day.

- Home-based care or nanny-share for a season.

- Check eligibility with Work and Income even if you’re unsure.

FAQ: budgeting for childcare in NZ

Can I get 20 Hours ECE and still pay a bill?

Yes. You can’t be charged *fees* for the 20 funded hours, but you can be charged for hours outside those 20. Services may also request optional charges (for example, food or excursions) if you agree to them. MoE: https://www.education.govt.nz/early-childhood/funding-and-data/20-hours-ece-for-ece-services

How do I budget for FamilyBoost if it’s paid quarterly?

Build a sinking fund. Estimate your quarterly claim, divide by 3, and subtract that amount from your monthly childcare budget. Details: https://www.ird.govt.nz/familyboost/can-you-get-familyboost/how-much-familyboost-are-you-eligible-for

Does returning to work reduce Working for Families?

It can. Working for Families is income-tested and generally reduces as family income rises. Use IRD’s estimator to estimate the change: https://www.ird.govt.nz/working-for-families/estimate-your-entitlement

What’s the fastest way to estimate my net childcare cost?

Start with your provider’s weekly invoice, then model 20 Hours ECE (if eligible), any WINZ subsidy, and your expected FamilyBoost refund. Our tool does the first pass for you: /cost-estimator

Why is under-2 childcare so much more expensive?

Staffing ratios are tighter. Under the ECE regulations, all-day centres need 1 adult for up to 5 children under 2 (and more staff as numbers rise), which increases wage costs. Source: https://www.legislation.govt.nz/regulation/public/2008/0204/latest/dlm1412637.html

A practical next step

Don’t budget childcare as a single number. Budget it as a system — fees, extras, subsidies, and timing.

Start by running your situation through our estimator, then adjust it with the reality of your centre’s policies and your work plans: Childcare cost estimator.

Estimate your real childcare budget

Enter your region, care type, child’s age, and household income to see an estimate after 20 Hours ECE, FamilyBoost, and WINZ support.

Try the cost estimatorRelated guides

Childcare Costs for Under-2s: Why Infant Care Is More Expensive and What You Can Do

Infant care costs more in NZ because under-2 rooms must staff to a 1:5 ratio. See 2026 price ranges, regional estimates, subsidy options, and ways to cut the bill.

WINZ Childcare Subsidy: A Step-by-Step Application Guide for NZ Parents

The WINZ Childcare Subsidy pays up to $6.52/hour towards approved ECE for under-5s. This guide covers eligibility, income thresholds, how to apply, what documents you need, and how to stack it with 20 Hours ECE and FamilyBoost.

How Much Does Childcare Cost in NZ? The Complete 2026 Guide

Childcare in New Zealand costs between $150 and $450 per week for full-time care in 2026. This guide breaks down costs by care type, child age, and region — plus every subsidy available to reduce your bill.

Part-Time vs Full-Time Childcare: Finding the Right Balance for Your Family

Should you go part-time or full-time? Compare costs, hours, developmental research, and provider types to find the right childcare balance for your NZ family.

Find childcare near you

Search and compare providers by suburb, care type, cost, and availability.