Resource Hub

FamilyBoost childcare tax rebate: how to claim back up to $6,240 a year

Published · Last updated · 6 min read

Contents

What is FamilyBoost and how much can you get back?

FamilyBoost is a government tax credit that refunds up to 40% of your early childhood education fees, to a maximum of $6,240 per year. It's administered by Inland Revenue and available to NZ households earning under roughly $229,000 annually. You claim it quarterly through myIR after uploading your ECE provider's invoice or statement.

What is FamilyBoost?

FamilyBoost is a quarterly tax credit from Inland Revenue that puts money back in your pocket for childcare fees. If your child attends a licensed ECE centre, home-based service, or kōhanga reo, you can claim a percentage of those fees back every three months.

The scheme got a major upgrade on 1 July 2025. The rebate jumped from 25% to 40%, and the annual cap nearly doubled from $3,900 to $6,240. The income threshold also rose, so more families now qualify. If you applied before and missed out on income grounds, it's worth checking again.

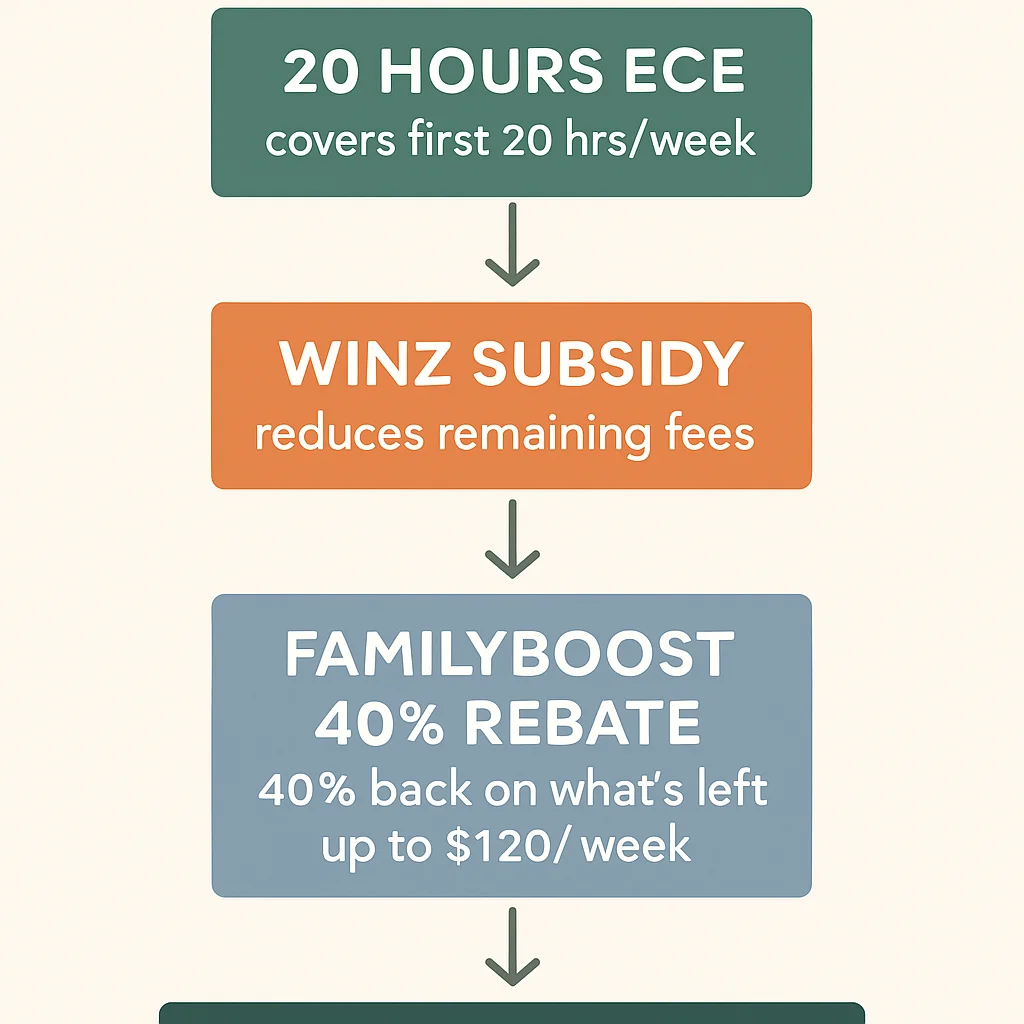

FamilyBoost works alongside 20 Hours ECE and the WINZ Childcare Subsidy. You're not choosing between them. Your FamilyBoost rebate is calculated on the fees left over after those other subsidies have been applied. For a fuller picture of all the support available, see our complete childcare costs guide.

Who qualifies for FamilyBoost?

The eligibility rules are straightforward. You need to tick every box on this list:

- Your child is 5 or under. FamilyBoost covers ECE-aged tamariki. Once they turn 6 or start school, you can no longer claim.

- You use a licensed ECE provider. Daycare centres, home-based care networks, kindergartens, kōhanga reo, and playcentres all count, as long as they hold a Ministry of Education licence. You can check if a provider is licensed on the Education Counts website.

- Your household income is below $57,286 per quarter (roughly $229,000 per year before tax). This threshold applies from 1 July 2025 onwards. Previously it was $45,000 per quarter.

- You're a New Zealand tax resident.

- Only one partner registers. If you have a partner, one of you registers for FamilyBoost. You can't both claim for the same child.

Separated parents

How much can you claim?

The maths is simple: FamilyBoost refunds 40% of your ECE fees, capped at $120 per week or $1,560 per quarter. That's $6,240 per year at the maximum.

But the full 40% only applies if your household earns under $35,000 per quarter ($140,000/year). Above that, the rebate shrinks by 7 cents for every dollar you earn over $35,000. By the time you hit $57,286 per quarter, the rebate reaches zero.

| Detail | Pre-July 2025 | From July 2025 |

|---|---|---|

| Rebate rate | 25% | 40% |

| Weekly cap | $75 | $120 |

| Quarterly cap | $975 | $1,560 |

| Annual cap | $3,900 | $6,240 |

| Income threshold (quarterly) | $45,000 | $57,286 |

| Abatement rate | 9.75c per $1 over $35k | 7c per $1 over $35k |

Real examples: what families actually get back

These three scenarios show how FamilyBoost works at different income levels. All assume one child in full-time daycare at $350 per week, after any 20 Hours ECE has already been applied.

- Household income $120,000/year ($30,000/quarter): Below the $35,000 abatement threshold. 40% of $350 = $140/week, but capped at $120/week. You'd receive $1,560 per quarter, or $6,240 per year.

- Household income $170,000/year ($42,500/quarter): The abatement kicks in. $42,500 is $7,500 over the $35,000 threshold. Reduction: $7,500 x 0.07 = $525. Your quarterly cap drops from $1,560 to $1,035, giving you roughly $4,140 per year.

- Household income $220,000/year ($55,000/quarter): $55,000 is $20,000 over $35,000. Reduction: $20,000 x 0.07 = $1,400. Your quarterly cap drops from $1,560 to $160, giving you roughly $640 per year. Still worth claiming.

How to claim FamilyBoost: step by step

You only need to register once. After that, claiming takes about five minutes each quarter.

- Register in myIR. Log in at myIR, go to the FamilyBoost section, and complete a one-off registration. You'll need your IRD number and your child's details.

- Get your invoice or quarterly statement from your ECE provider. Ask your centre for a quarterly statement. It should show the dates, fees charged, and any subsidies already applied (like 20 Hours ECE). One statement per quarter is enough.

- Upload the document in myIR. PDFs work best. If you only have a photo, that's fine too, but make sure the details are legible and your phone's live photo function is turned off.

- Submit your claim. Double-check the amounts, hit submit, and you're done.

- Get paid. IRD deposits the rebate straight into your bank account, usually within a few weeks of submitting.

Set a quarterly reminder

What expenses count (and what doesn't)

This catches people off guard: FamilyBoost covers more than just the base fee. According to IRD, you can claim the optional charges on your invoice that relate to the education and care of the child.

You can claim

- ECE fees (the main weekly or daily rate)

- Teaching resources and building levy

- Food and meals provided by the centre

- Nappies, wet bags, and clothing supplied by the centre

- Sunscreen

- Excursions and entrance fees

- Transport provided as part of the service

You cannot claim

- Fundraiser purchases

- All-day parking leases

- Goodwill payments and donations

- Fees from unlicensed providers (private nannies, babysitters, informal arrangements)

Common mistakes that delay your rebate

- Forgetting to claim. There's no automatic payment. If you don't submit a claim each quarter, you miss out. FamilyBoost doesn't square up at the end of the tax year either.

- Uploading blurry photos. If IRD can't read the invoice, they'll ask for a clearer copy, which pushes your payment back by weeks.

- Both partners registering. Only one person per household can register. Duplicate registrations create a mess that takes time to sort out.

- Including non-qualifying costs. Claiming fundraiser purchases or donations flags your claim for manual review.

- Missing the quarterly statement. Ask your provider at the start of each quarter for last quarter's statement. Some centres send them automatically; others need a nudge.

Stacking FamilyBoost with 20 Hours ECE and WINZ

You can use all three subsidies together. They don't cancel each other out. They stack in a specific order:

- 20 Hours ECE is applied first by your provider (if your child is 3-5 and the centre participates). This covers up to 6 hours per day, 20 hours per week of ECE fees.

- WINZ Childcare Subsidy is applied next (if you qualify based on income and work/study activity). This reduces your remaining bill further.

- FamilyBoost is calculated on whatever's left after the first two subsidies. You get 40% of that remaining amount, up to the cap.

For a three-year-old in full-time daycare, this means 20 Hours ECE covers the first 20 hours, WINZ might cover a portion of the remaining hours, and FamilyBoost refunds 40% of what you still owe. A family on $130,000 could easily save $8,000-$12,000 a year across all three. Use our cost estimator to see the numbers for your situation.

Under-2s benefit most from FamilyBoost

Frequently asked questions

Is FamilyBoost per child or per household?

FamilyBoost is calculated per household, not per child. However, you can include ECE fees for all eligible children (aged 5 and under) in a single claim. The $1,560 quarterly cap applies to the total fees claimed.

Can I claim FamilyBoost if my child goes to kindergarten?

Yes. Any licensed ECE provider qualifies, including kindergartens, daycare centres, home-based care services, kōhanga reo, and playcentres. Check your provider's licence status on the Education Counts website.

What if I forgot to claim last quarter?

You can still claim for earlier quarters. In myIR, go to FamilyBoost periods and find the quarter you missed. There's no penalty for late claims, but it's best to claim regularly so you don't lose track of invoices.

Do I need to declare FamilyBoost on my tax return?

No. FamilyBoost is a standalone tax credit processed separately from your income tax. It doesn't affect your Working for Families entitlements either.

What happens if my income changes between quarters?

IRD assesses each quarter independently. If your income drops one quarter (say, due to parental leave or reduced hours), you might qualify for a higher rebate that quarter even if you didn't the quarter before. Each claim is final at the time of assessment.

Can I claim for a nanny or au pair?

Only if the nanny or au pair operates through a licensed home-based care network. Private nanny arrangements without a licensed provider don't qualify for FamilyBoost.

FamilyBoost is one of the simplest subsidies to claim, yet thousands of eligible families don't use it. Five minutes on myIR each quarter could put up to $6,240 back in your account over a year. If you're paying for ECE and earning under $229,000 as a household, register today. For a full breakdown of all childcare subsidies and what they mean for your budget, read our complete guide to childcare costs in NZ.

See how much you could save

Use our cost estimator to calculate your childcare costs after FamilyBoost, 20 Hours ECE, and WINZ subsidies are applied.

Try the cost estimatorRelated guides

Find childcare near you

Search and compare providers by suburb, care type, cost, and availability.